top of page

Mutual Funds Investing in Your Financial Future

Welcome to the world of mutual funds, where your money has the potential to grow and work for you.

Debt Mutual Funds

Seek stable returns with carefully curated fixed-income portfolios. Our experts select high-quality bonds and debt instruments to provide steady income with lower risk.

Various types of

Mutual Funds

Equity Mutual Funds

Life's uncertainties can bring financial challenges for your loved ones. A Term Plan serves as a safety net, providing a lump-sum payout to your family in case of your unfortunate demise. This ensures they can maintain their lifestyle, fulfill aspirations, and secure their future without financial stress.

Hybrid Mutual Funds

Invest in a diversified equity portfolio designed for capital appreciation. Our experts identify growth opportunities in companies across sectors, aiming for long-term wealth accumulation.

Tax Efficiency

Certain funds offer tax benefits, such as equity-linked schemes' long-term capital gains tax exemptions.

Risk Reduction

Diversification and professional management help mitigate investment risks, enhancing overall financial security.

10 Benefits of investing in

Mutual Funds

Diversification

Mutual funds spread your investment across a variety of assets, reducing risk associated with individual stocks or bonds.

Flexibility

Various fund types cater to different risk profiles and financial goals, offering choices for every investor.

Professional Management

Transparency

Experienced fund managers make investment decisions, improving the likelihood of higher returns.

Liquidity

Regular reporting of holdings and performance keeps investors informed about their investments.

SIPs enable disciplined investing, allowing you to invest fixed sums regularly.

Systematic Investment

With low minimum investment amounts, mutual funds are cost-effective investment options.

You can buy or sell mutual fund units at the end-of-day NAV, providing liquidity compared to other investments.

Mutual funds allow even small investors to access professionally managed, diversified portfolios.

Accessibility

Diversification

How to invest in Mutual Funds?

3 steps to start your Mutual fund investment journey

Step 1

Open a Free Mutual Fund account by Completing Digital KYC

Step 2

Select a Mutual Fund

Step 3

Invest One Time or SIP with as low as ₹100

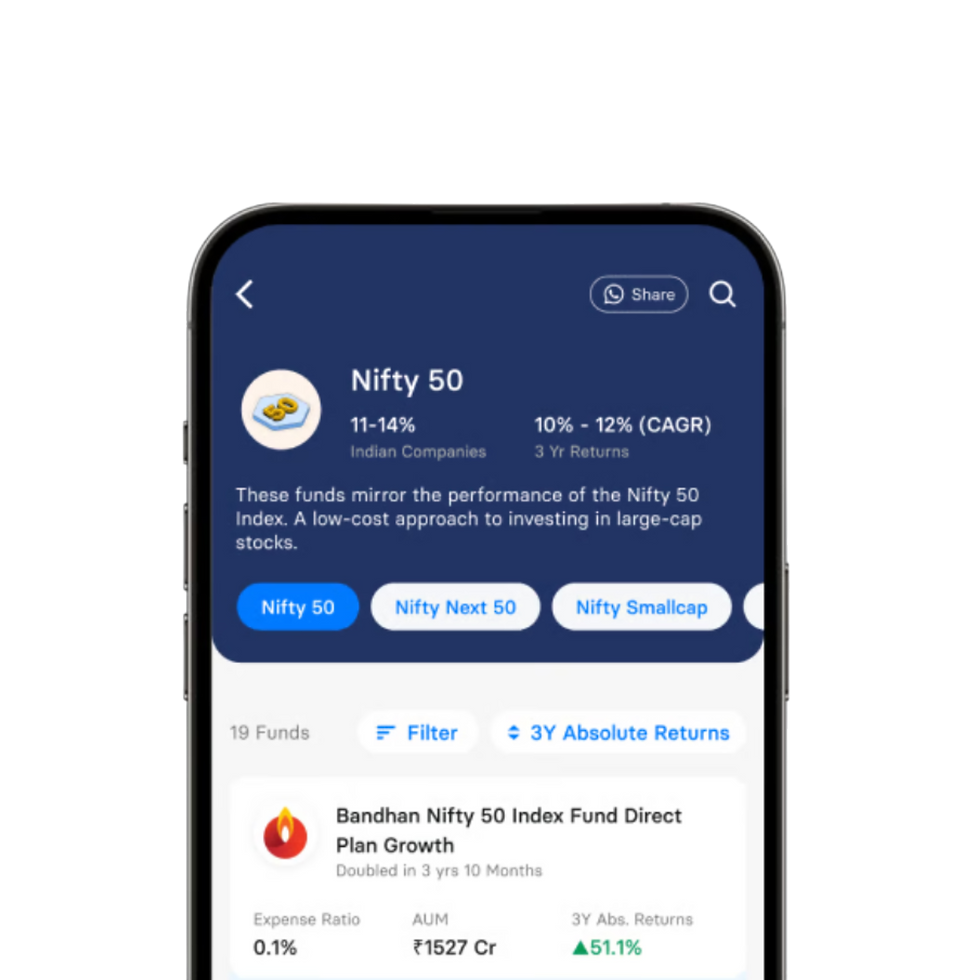

Mutual Funds by Category

Mutual funds can be classified into three main categories: Equity, Debt, and Hybrid Mutual Funds.

1. Equity Mutual Funds

Large Cap Mutual Funds

Mid Cap Mutual Funds

By investing at least 65% in mid-cap companies with a market capitalisation of ₹5,000 crore to ₹20,000 crore, these funds aim for growth with moderate risk, balancing the higher potential of mid-caps against the volatility of small-caps.

Invests at least 80% in large-cap stocks from the top 100 companies with a market capitalisation of ₹20,000 crore or more. Large-cap funds aim for stability and growth with lower volatility than mid and small-cap funds.

Flexi Cap Mutual Funds

Small Cap Mutual Funds

Flexi cap mutual funds are equity funds with the flexibility to invest across large, mid, and small cap companies. This adaptability allows the fund manager to choose investments based on the performance of various companies.

Requires a minimum of 65% investment in small-cap companies, which have a market capitalisation of less than ₹5,000 crore. These funds focus predominantly on small-cap stocks to capture higher growth opportunities.

2. Debt Mutual Funds

Corporate Bond Funds

Money Market Funds

At least 80% of the investments

are in high-rated corporate bonds. They focus on quality and stability in the corporate bond market.

Focuses on money market instruments with a maturity of up to one year. They provide liquidity and low-risk options for conservative investors.

Liquid Funds

Overnight Funds

Invests in debt and money market instruments with a maximum maturity of 91 days. Aims to provide high liquidity and low risk for short-term investments.

Invests in securities that mature in just one day. Overnight funds provide liquidity and stability while minimising risk.

3. Hybrid Mutual Funds

Aggressive Funds

Arbitrage Funds

Employs an arbitrage strategy to capitalise on price differences between markets, investing at least 65% in equities with a focus on exploiting these opportunities.

Allocates 65-80% to equity and 20-35% to debt. They lean more toward equity for higher returns while still including debt for stability.

Multi Asset Funds

Equity Savings Funds

These funds invest in a mix of equities, debt, and arbitrage opportunities, aiming to balance risk and returns. They provide moderate growth potential with relatively lower volatility than pure equity funds.

These funds allocate at least 10% of their total assets across a minimum of three asset classes, such as equity, debt, gold, and others.

Mutual Funds Collections

A curated selection of the best mutual funds for different investment goals

Invest in funds that have been popular with the INDmoney investors in the past 6 months.

Allocates 65-80% to equity and 20-35% to debt. They lean more toward equity for higher returns while still including debt for stability.

ELSS are tax-saving mutual funds that invest in equities, offering both capital growth and tax benefits under Section 80C.

High Return Funds

High Return Funds are investment vehicles that aim for superior returns by focusing on high-growth assets as equities and high-yield securities.

Best SIP Funds is a list of hand-picked mutual fund schemes that have given better SIP returns compared to other Funds in the same category.

Gold mutual funds let you benefit from gold prices without owning it, offering a hedge against inflation and market volatility.

These mutual funds balance risk and return, serving investors seeking a middle ground between growth and capital preservation.

Provides stability and preserve capital while offering modest returns. These funds typically invest in securities that have lower volatility and are less sensitive to market fluctuations.

These funds are investment vehicles designed for investors who are willing to accept a higher level of risk in exchange for the potential for substantial returns.

What India feels

about PKT SECURITIES

FAQS

Questions? 5 things to know in 5 minutes or less.

bottom of page